Builders Risk Insurance Quote

Surety bond

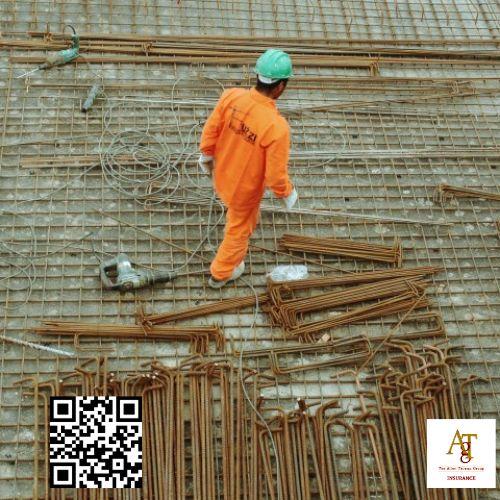

It offers contractors peace of mind by extending their liability coverage and ensuring they are adequately protected in case of large claims or lawsuits. The Allen Thomas Group Contractor Insurance . This ensures that they have adequate coverage in the event of a claim, as exceeding the policy limits could leave them personally liable for any additional costs. This is covered by general liability insurance, an essential part of a contractors insurance policy. Call (440) 826-3676 for a free contractor insurance quote today. From custom policies designed specifically to fit individual responsibilities and exposures to policies tailored for public or non-profit institutions and financial institutions.

This major expense comes on top of work delays, decreased productivity and legal fees. Learn six ways contractors can effectively manage their cost of risk to help improve their bottom line, their reputation and worker safety. Independent contractors typically have obligations under their work contracts regarding insurance requirements that must be fulfilled, which often state whether the company needs to be added as additional insured. Don't let this happen to you.

The Allen Thomas Group offers products and insights to help our customers stay ahead of risk by preparing for it and ultimately helping to reduce loss costs and keep projects running smoothly. General Liability Insurance also covers any damage your completed projects might cause after work is finished. Insurance doesn’t have to be complicated. Running a contracting business comes with many risks that can lead to expensive claims, lawsuits, or losses.

As a contractor, you want an insurance resource who becomes an invaluable, long-term business partner. Cargo insurance It combines both coverages under one policy, and usually has lower insurance premiums than buying each policy separately from the insurance company. One of the key components affecting contractors insurance costs is your specific trade's nature of work. Common trades that need contractors insurance include:It’s always good to have insurance in case of mishaps, even if you don’t contractually need coverage.